Seeing Connected TV Through a Search Marketer Lens

by Jaci Schreckengost

3 Min Read

CES 2024: Stagwell (STGW) and MNTN Announce Partnership in Unified Performance SolutionsLearn More

Thought it was only viewers who are choosing ad-supported over ad-free? Ironically, so too are the ad-free networks.

3 Min Read

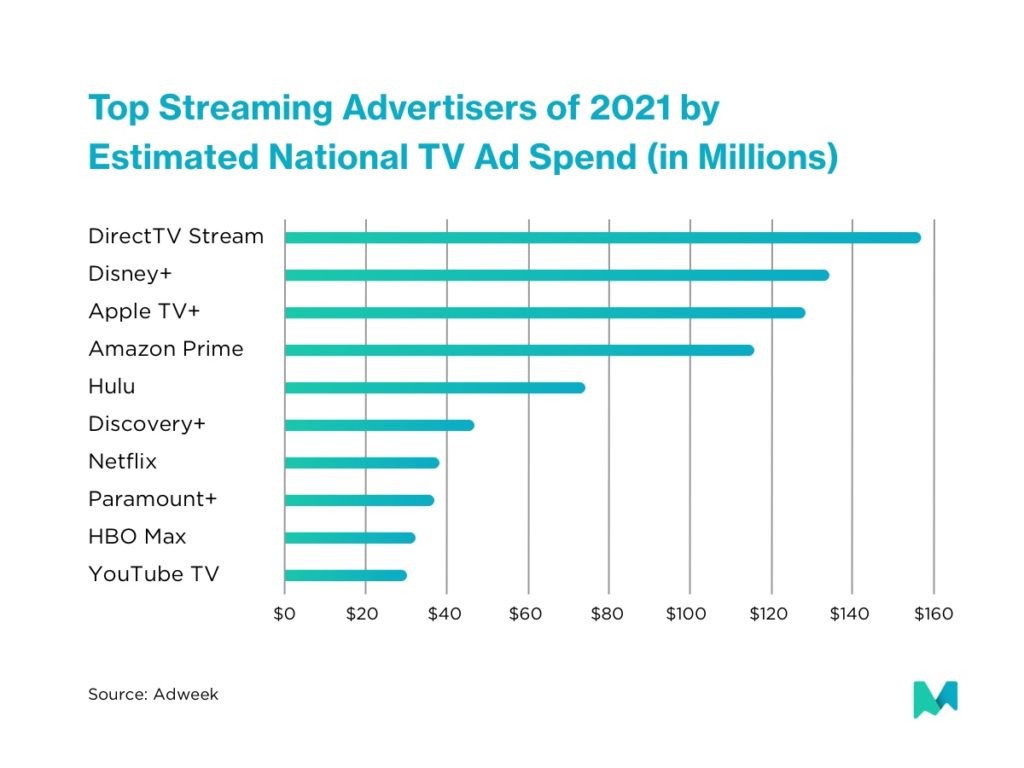

Nearly two-thirds of viewers said they would choose ad-supported TV over an ad-free subscription, and even welcome ads as long as they are relevant and not overly cumbersome—and as we had predicted, it’s not only the viewers who are turning their gaze to ad-supported instead of ad-free. In fact, the latest data cited in an Adweek article earlier this week revealed that ad-free streaming networks, including Disney+, Apple+ and Amazon Prime, were ironically among the top streaming advertisers by estimated national TV ad spend this year.

While it’s certainly ironic, who can blame them? Leading market research provider, eMarketer, found that TV commercials are driving much of this discovery to new streaming content (34%) —and even more than social media (20%). And, for the first time ever, industry experts are seeing the gap closing between proverbial ad dollars and eyeballs. “This is the [first] time in my career that the dollars and the eyeballs are actually kind of in parity,” said Interactive Advertising Bureau (IAB) Senior Vice President of Research and Analytics Sue Hogan. An IAB survey of over 350 advertising executives found that Connected TV (CTV) advertising spending per advertiser increased on average by 22% in 2020, and that upfront negotiations this year were skewing in CTV’s favor, with ad spend increasing by nearly 50%.

CTV advertising is one of the fastest growing channels in the US ad spending market, and let’s not forget—marketers are as much consumers as the CTV viewers in this growing market. Sixty percent of US marketers said they were shifting their ad dollars from linear TV to CTV this year. So, why are ad-free platforms jumping on the ad-supported bandwagon? “While we are seeing growth across all digital video, the movement to more audience-based buying approaches has resulted in increased buyer demand for CTV,” cited Eric John, Vice President of IAB Media Center.

From a user-acquisition perspective, Connected TV’s audience-targeting capabilities, combined with a superior viewing experience are hard to beat. Platforms like MNTN Performance TV help brands measure the direct impact of their ads, including revenue, cost per acquisition, conversion rates and more. Additionally, since such platforms serve relevant ads based on audience-first targeting (not network-first), there’s no guesswork needed. Brands can even generate insights on which Connected TV networks are driving the most performance, and can use this intel to test, iterate, and refine their ad strategy.

If history is any measure (looking at you, Netflix), it’s apparent that ad-free subscription platforms can only sustain their business models through increasing their costs, which will eventually hit the cap of what consumers are willing to pay. Ad-supported networks meanwhile offer much more flexibility and are seen as better value to consumers—and can always offer lower price points than ad-free models. That’s good news for advertisers looking to reach consumers who are increasingly gravitating toward ad-supported streaming networks. Coupled with CTV’s targeting and measurement capabilities, it presents a major ad-supported opportunity for all brands.

Subscribe to the report Apple, Amazon, NBC and more use to get their CTV news.