Blast From the Past: Streaming is Reviving the TV of Old

by Frankie Karrer

4 Min Read

CES 2024: Stagwell (STGW) and MNTN Announce Partnership in Unified Performance SolutionsLearn More

Advertising, Connected TV, Reporting

Linear TV Thinking Won’t Cut it in a CTV World

3 Min Read

Connected TV as we know it is at least fifteen years old. Over the last decade, streaming entertainment has exploded globally, with new platforms appearing annually, an adoption rate that continues to soar, and more people cutting the cord than ever. While advertisers are following their consumers to Connected TV marketing platforms, many digital providers continue to treat CTV like its linear forebear. CTV has changed the advertising game for good – and the strategies and measurement methods of yesterday won’t cut it tomorrow.

Last week the MNTN marketing team discussed YouTube, its lack of the right measurement tools in place, and its plan to rely on Nielsen ratings – causing friction amongst advertisers and marketers. The world of Connected TV moves fast, and this week YouTube announced that they’re looking to improve their CTV advertising with Comscore ratings. The Comscore integration is designed to help advertisers “understand combined co-viewing for YouTube and YouTube TV across OTT/CTV as well as incremental reach to their linear TV buys,” according to Comscore.

The news demonstrates the growing need for marketing metrics and analytics tools for advertisers. Unfortunately, while Comscore ratings are a welcome improvement for many advertisers, they still exist behind YouTube’s walled garden. In other words, it might provide valuable insights into your campaign performance, but it will only show that campaign data on YouTube’s platform alone – giving marketers just a glimpse of how their overall campaign is performing.

Earlier this week, Roku announced they’re releasing 23 new Quibi series under their Roku Originals banner. The series will be available to stream on Roku’s in-house AVOD offering, The Roku Channel, starting August 13th.

The news represents Roku doubling down on original content with the intent to allure and attract advertisers. It also comes on the heels of Nielsen beginning to include The Roku Channel in its CTV rankings for the first time. Roku is excited about the announcement of a slate of new content, claiming that it, alongside Nielsen’s recognition, makes The Roku Channel a “premier place for audience scale.” However, this year has shown that Nielsen data might not be providing the best picture – and Roku’s content is entering a very competitive landscape. While the channel was the sixth most streamed channel by household reach in June, the company has reported a decline in total streaming hours in Q2 – dropping from 18.3 billion in Q1 to 17.4 billion.

For many advertisers, these new features may be welcome, but not enough. While original programming and traditional measurement methods were a mainstay of linear TV, today’s marketers just want a channel to run campaigns and drive conversions. Modern marketing departments are driven by growth metrics and producing hard data to show ROI. As CTV and digital formats continue to grow, so too will this need. And it’s that need that often drives marketers to have a conversation with MNTN.

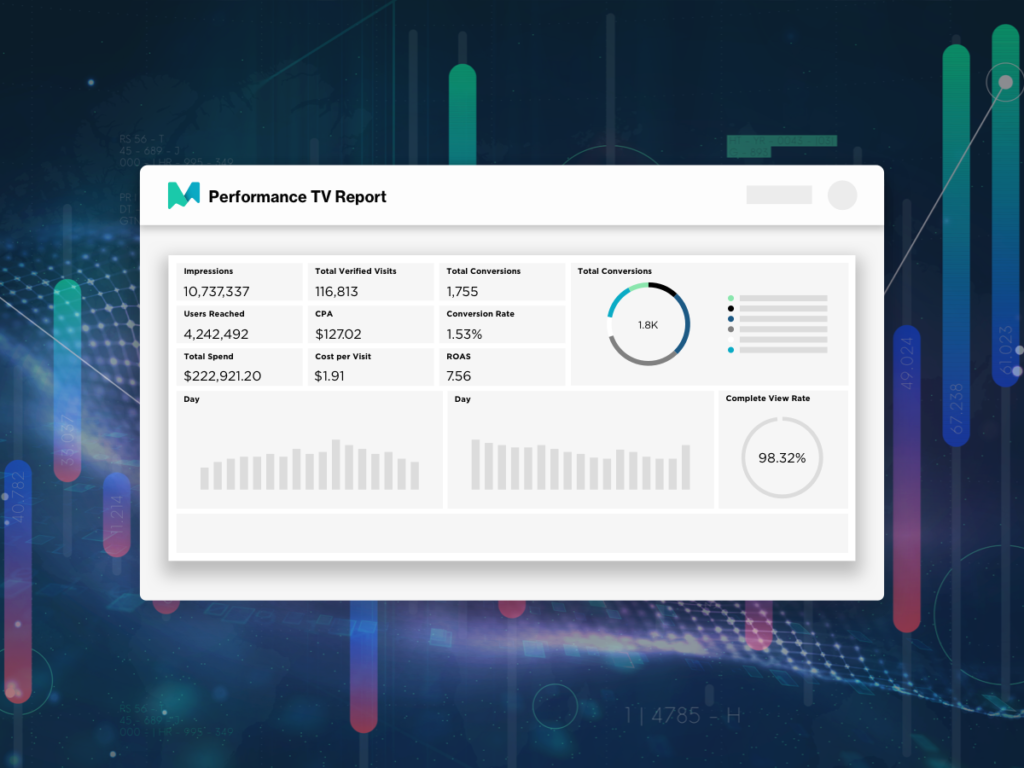

MNTN isn’t diverting focus to produce original content and doesn’t present data metrics on just one platform. What we do have is Performance TV, the world’s first and only CTV advertising platform optimized for direct response marketing goals. The result is advertising software for brands to unlock television’s true performance potential by combining the impact and power of prestige TV with a suite of targeting and optimization tools. Performance TV leaps over the walled gardens of in-house analytics tools to transform CTV from a brand marketing channel to one that functions like paid search and social – enabling you to launch self-managed campaigns that focus on what matters: conversions and revenue.

Every major advancement has holdouts from the previous era, accustomed to traditional methods. After the automobile’s invention, some still rode a horse and buggy. Many people held onto their flip phones for years after the smartphone’s release. And some digital providers continue to adhere to the mindset of linear TV to Connected TV. But like the car and smartphone, change is inevitable – and the advertisers who recognize this now are better positioned for tomorrow.