CTV Retargeting 101: Complete Guide for TV Advertisers

by Frankie Karrer

Min Read

Check out Inc.’s excellent coverage on MNTN’s mission to make TV advertising impactful (and accessible) for all. Learn More

New research finds Connected TV and OTT have eclipsed mobile and social on 2021 marketing channel priority lists

4 Min Read

If you’re launching a DTC (aka direct to consumer) brand, the playbook says your first stop is Instagram. Its visual format and wide-ranging user base is a good combination for advertisers who need to establish their voice and identity among their key audiences.

The only catch is that every other DTC advertiser is following the same playbook. It’s become an extremely crowded space—so much so that there are reports of Instagram and Facebook acquisition costs doubling or tripling over the past year. This is something that can force DTC brands, which rely on strong margins driven by their ad campaigns, to seek out new ad channels.

DTC brands not only need to stand out, they rely on low CPA calculations to drive their margins. Rising costs and a crowded field have blunted Instagram’s effectiveness—news that is circulating among industry insiders.

“When I spoke to other founders and other investors, they were like, ‘Be careful of approaching Instagram, it can become a money suck and it is really noisy,’” said Kim Pham, co-founder of DTC food brand Omsom, in an interview with Digiday. And while it’s unlikely these brands will abandon Instagram completely (Pham later states she still leverages the platform), it is likely we’ll see a shift in strategy.

So where would that shift take these advertisers? Paid search, while an effective direct-response channel, lacks the visual storytelling component that’s crucial in the DTC space. Other video-driven social networks, like TikTok, could see more budgets come their way—but social may be taking a backseat to another visual-driven ad channel.

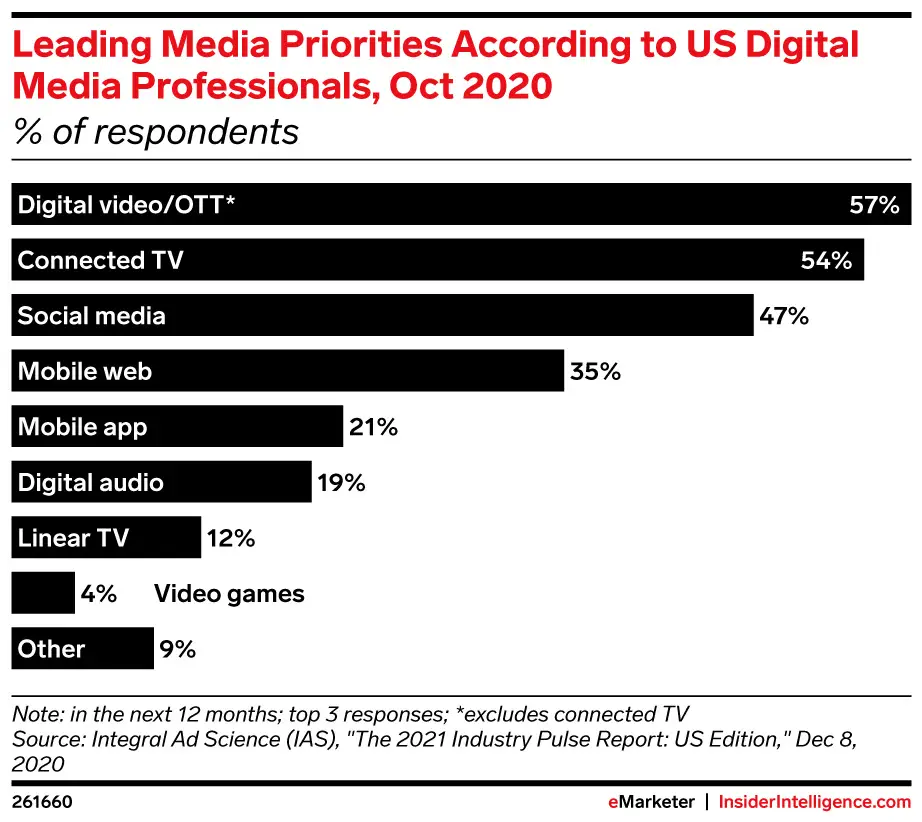

A recent study published by Integral Ad Science found Connected TV and OTT/digital video dethroned both social and mobile on marketers’ 2021 priority list. Massive changes in consumer habits—which were once so mobile-oriented—have become much more tied to the home. Channels like Connected TV, of which the vast majority is streamed on televisions, benefit from that shift. And with 78% of users exclusively accessing social networks via their smartphones, that’s put a dent in social’s 2021 prospects.

While mobile usually sits at or near the top of the priority list, 2021 sees it fall out of the top 3 altogether. Social, strongly correlated with mobile, came in third behind digital video/OTT and Connected TV.

Mobile and social saw a lot of use while people were going about their normal, every day routines away from home. COVID-19 and its associated stay-at-home orders have changed those habits, and the result has been more at-home media consumption.

Advertisers are responding by finding channels that support that shift, but it’s not the sole reason for the excitement around OTT marketing and Connected TV. Marketers’ perception of Connected TV’s measurement, attribution, and audience targeting capabilities have improved over time. The majority of respondents (62%) also see digital video, OTT, and Connected TV as being the channels with the most potential.

The same advancements in targeting and attribution that helped it rocket up marketers’ 2021 priority lists have also taken Connected TV from a branding channel to one that’s capable of direct-response advertising.

While CPMs on the open market for Connected TV are higher than those of social, ad platforms designed to facilitate direct-response marketing on CTV leverage PMP deals to lower costs and increase ROI. It’s these types of considerations that make it a viable performance channel, and its likely more ad solutions will adopt them as more advertisers leverage it for that purpose.

As DTC brands look for ways to get away from a crowded social scene, Connected TV advertising could prove to be an effective outlet. Its visual format, coupled with direct-response ad capabilities, could prove to be a natural fit for these brands in 2021.

Subscribe to the report Apple, Amazon, NBC and more use to get their CTV news.