Seeing Connected TV Through a Search Marketer Lens

by Jaci Schreckengost

3 Min Read

CES 2024: Stagwell (STGW) and MNTN Announce Partnership in Unified Performance SolutionsLearn More

Six reasons why Fortune 500 brands should rethink their CTV ad buying platform

9 Min Read

It wasn’t so long ago that we first discussed the ways in which MNTN’s Performance TV platform differed from popular DSPs (Demand Side Platforms). Since then, the streaming TV advertising landscape has changed dramatically—forcing marketers everywhere to take a closer look at the way they’re leveraging Connected TV to achieve measurable KPIs.

Over the past year, CTV viewership has skyrocketed, as US residents now watch streaming TV for an average of 80 minutes per day. Meanwhile, the ad industry took notice of changing consumer behaviors, and programmatic budgets spent on CTV grew by 82.4%. This year, those budgets are projected to continue growing by another 39.2%.

As every marketer and Marvel fan knows—with great budgets, comes great responsibility. As the dust settles around the industry’s initial scramble to get ads on CTV, marketers are now taking a moment to reevaluate the platforms they’re using to drive performance in this new era of streaming television. As we all know, DSPs are perfectly capable of accessing Connected TV inventory, but optimizing those CTV ads to drive and accurately measure outcomes is another story.

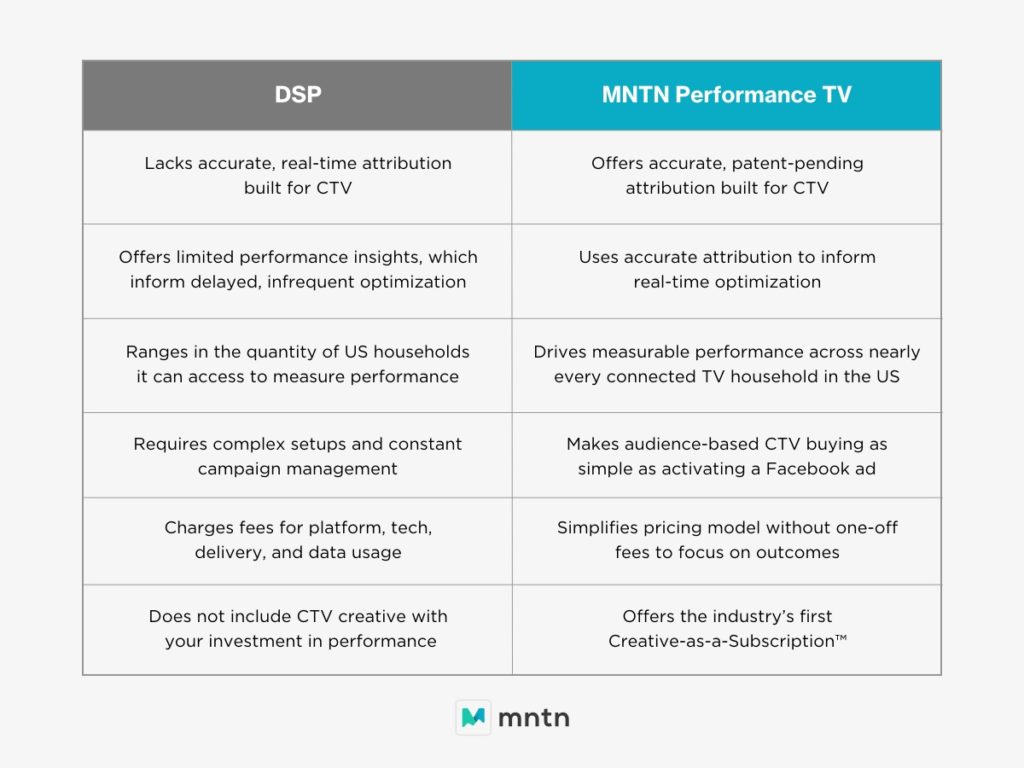

Here are 6 ways MNTN’s Performance TV differs from most Demand Side Platforms.

1. Trust that Your CTV Attribution Is Accurate and, Deterministic

Performance TV: With patent-pending measurement, MNTN offers brands the ability to apply accurate and entirely deterministic attribution to their CTV campaigns—an industry first. We call this attribution model Cross-Device Verified Visits.

Here’s a quick walk through how it works:

MNTN also offers two unique ways of measuring Verified Visits. Our standard attribution model and Last Touch Verified Visits. With Last Touch Verified Visits, MNTN ensures that Performance TV only takes credit for visits when it is the sole, last-touch channel driving a site visit. In other words, MNTN Performance TV provides brands with automatic, deduplicated visit attribution—empowering those brands with the ability to compare the incremental impact of their CTV campaigns alongside their other marketing channels.

DSP: Unlike MNTN, DSPs have not developed a truly deterministic, real-time attribution model to measure performance driven by CTV ads. Furthermore, they don’t have the flexibility to measure CTV as a true last-touch channel. This lack of flexible CTV-specific attribution forces brands to apply existing digital measurement models to their CTV efforts—which lack accuracy and force marketers to spend countless hours reconciling those reports to partially connect the dots.

For example, if a brand uses Last-Click attribution, they’ll always under-attribute performance to Connected TV because CTV devices aren’t clickable. Even in the less common cases when a brand retargets users exposed to CTV ads with ads served on other devices and attributes click-throughs back to CTV, this attribution model misses out on common instances where an individual watches a CTV ad, then decides to visit that brand’s website and takes an action. Without a deterministic, cross-device understanding of that event, every one of those CTV-driven attribution events are lost.

In some circumstances, marketers may attempt to manually create a form of Last Touch attribution measurement, but the process is also incredibly manual and time-consuming. To attempt deduplication, marketers are required to pull impression delivery against household IPs, cross-reference them with all of their performance outcomes, then cross-reference those outcomes with last-touch outcomes driven by other marketing channels and manually remove duplicated efforts. And even this process for deduplication is limited. IP information is not always readily available, and in instances where that IP info isn’t passed back to the DSP, that CTV visit attribution is lost. That’s why MNTN takes an ID-agnostic approach—going beyond IPs and using a variety of identifiers—to ensure attribution is understood holistically.

2. Power Real-Time Optimization With Accurate Attribution

Performance TV: As mentioned, Performance TV deterministically measures visit attribution in real time— providing immediate, accurate, and actionable insights. On top of that, MNTN’s platform has a built-in, automated media buying engine that uses MNTN’s real-time attribution to make two-hundred thousand decisions per second that inform continuous campaign optimizations every day— all driving towards performance outcomes. In short— DSPs use imperfect attribution to guide manual optimizations, while MNTN offers marketers deterministic, real-time attribution to guide automated optimizations. The latter empowers marketers to drive better and more measurable performance with their CTV efforts.

DSP: As mentioned, DSPs either offer marketers imperfect performance reporting for CTV campaigns. So when DSP managers make optimization decisions, they’re often forced to use the information they have readily available—which to no fault of their own, is limited. This constraint limits even the strongest marketers’ ability to make the best possible optimization decisions, and unfortunately, this issue results in a lower ceiling for CTV’s ability to drive performance.

3. Drive Measurable Performance Across 120MM+ Households

Performance TV: By leveraging MNTN tracking pixels on brand sites, billions of ads served per month, and data on 646 million devices provided through our unique integration with Oracle and other third party providers, MNTN is able to gain a distinct understanding of the cross-device connections for over 120 million households—offering marketers the ability to target and accurately measure campaigns across nearly every connected TV household in the US.

While other solutions are reliant on one primary data source for household identification, MNTN’s Identity Graph remains ID agnostic by mapping a variety of signals to connect household devices, including IP addresses, device IDs, Google, and Adobe Analytics IDs, and more. This offers brands a long-term solution that is not reliant on cookies and abides by data privacy laws.

DSP: DSPs have taken a variety of approaches to device graphing, but most rely on a limited number of data sources for household identification—restricting their ability to build out identity graphs with the same granularity necessary to scale attribution. Even DSPs with the most advanced device graphs are often overly-reliant on IP addresses—limiting their ability to determine attribution at the same scale that an ID-agnostic solution is able to.

All of that said, even in the rare instances where a DSP claims to have an identity graph that’s somewhat similar to MNTN’s, it’s important to remember that the DSP’s device graph still powers inaccurate, duplicative attribution, thus limiting a marketer’s ability to optimize towards performance.

4. Make Performance TV As Simple To Activate as a Social Campaign

Performance TV: MNTN’s Connected TV platform is designed to make Performance TV activation and measurement as simple as activating a Facebook campaign. Just select your targeting and budgets, upload your creatives, and activate your campaign across 100+ of the top streaming networks in the US, including NBC, ESPN, Discovery, and more. From there, MNTN’s automated media buying engine optimizes your campaign thousands of times per day towards your performance goals—offering marketers the technology necessary to activate effectively without spending countless hours on campaign management. As your campaign progresses, you can customize your real-time reporting dashboard to view hundreds of metrics with complete transparency to inform your decision-making.

DSP: It’s no secret that most DSPs require marketers to complete full courses in order to attain the skill sets necessary to use them. Additionally, DSPs require constant manual optimizations. To deploy those optimizations, a brand either needs to allocate a significant portion of their media buying team’s time towards campaign setup, management, attribution, and optimization or pay for a managed service.

5. Invest in Business Outcomes, Not Fees

Performance TV: Unlike DSPs, MNTN’s business model is similar to that of Facebook’s ad platform—brands simply pay to activate campaigns that drive outcomes. By offering this model, we naturally absorb individual costs that brands would incur when using DSPs and provide our entire performance platform without any additional fee including access to over 80,000+ third-party audience segments, premium and brand-safe CTV inventory, patent-pending attribution, our automated optimization engine, CRM targeting, integrations with Google Analytics and Adobe Analytics, customized reporting, and more. In short, MNTN’s business model is designed to deliver and accurately measure a brand’s results, regardless of KPI or campaign setup.

DSP: Unlike MNTN, DSPs force brands to pay for fees, not outcomes. These fees can include, but are not limited to platform seat fees, CPM markups, tech fees, and fees for data segments used in audience targeting. That specific audience you want to reach may cost you an astronomical CPM upcharge—limiting your ability to drive performance.

6. Optimize Performance With Creative-as-a-Subscription

Performance TV: You can’t drive performance without strong creative messaging, and yet oftentimes, CTV ads are developed in a silo—away from the media activation teams that are trying to achieve their revenue goals. The process for developing these ads is lengthy and expensive, and teams are typically left to serve these ads on linear TV and legacy platforms like cable TV that don’t provide real-time results. This entire process makes it difficult to learn and iterate quickly—an absolute necessity for any successful performance marketing strategy.

Even brands with the largest creative budgets are limited in the number of effective CTV ads they can make per year. These restrictions can limit a brand’s ability to take advantage of the full spectrum of creative strategies that drive performance.

That’s why MNTN set out to make creative a more effective tool for performance marketers. So, in 2021, we acquired Ryan Reynold’s award-winning creative agency, Maximum Effort—aka the minds behind viral marketing campaigns for Deadpool, Aviation Gin, Mint Mobile, and more. In January, we announced the acquisition of QuickFrame by MNTN, the industry’s leading creative platform. By bringing these creative powerhouses together with MNTN’s Performance TV platform, we were able to launch the industry’s first-ever Creative-as-a-Subscription™ (CaaS) offering for brands.

With CaaS, marketers that commit to using the MNTN platform are provided with a continuous supply of high-quality, fully-produced CTV creative to help them achieve and exceed their revenue goals. By removing the limitations caused by strict creative budgets, brands can finally use creative as a true performance lever to drive better outcomes. Today, brands are already using CaaS to tailor messaging to unique audiences, capitalize on seasonal and cultural moments, increase A/B testing, and optimize their messaging to drive better outcomes. Plus, by pairing agile creative with MNTN’s accurate, real-time reporting, brands are able to test, learn, and iterate faster than ever before—all while elevating their equity with high-quality, relevant messaging they control.

DSP: With DSPs, brands don’t receive additional, performance-optimized creatives with their investment in media. To access the same breadth of creative opportunities available through CaaS, brands need to spend considerably more on production—taking away from their ability to drive performance. Alternatively, if brands opt to limit their creative spending and still activate via a DSP, they’re restricted to fewer opportunities to test and optimize messaging based on performance.

Subscribe to the report Apple, Amazon, NBC and more use to get their CTV news.