Local TV Advertising Costs: 10 Factors to Consider

by Frankie Karrer

1 Min Read

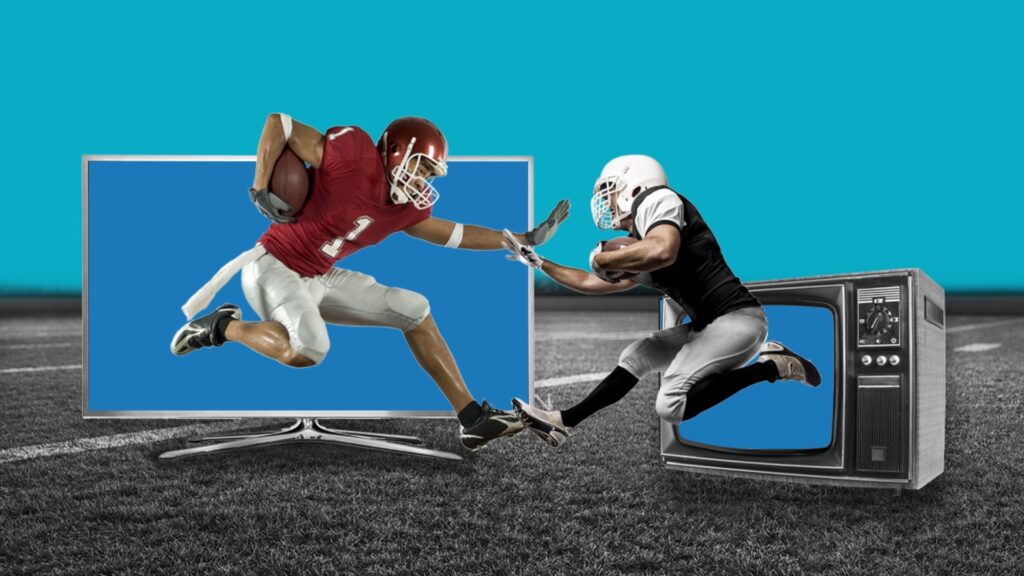

This past weekend football was either onscreen or unseen

5 Min Read

An alarming thing happened to football fans last Saturday. As millions of Americans sat down to watch college football with friends and family, fans started panicking—they couldn’t find ESPN to watch the game on Dish Network or Sling TV. No amount of channel flipping or restarting the service solved it—the channel, and the game that came with it, were gone.

And then came the panic.

The surprise wasn’t the result of some glitch or sinister hack: it was simply the result of a contract dispute between Disney and Dish Network. Earlier in the week, Dish claimed that Disney was demanding unreasonable rates with no regard for the public viewing experience. Disney argued that the rates they were seeking reflect the marketplace and Dish had declined to reach a fair agreement.

Either way, the damage was done. Disney blacked out their portfolio of cable networks and local stations (including ABC and ESPN) to customers of Dish and Sling TV, affecting nearly 10 million households. Football fans were shocked and outraged—and then they cut the cord.

The reason behind the blackout isn’t a surprise for anyone who’s had cable TV/satellite service like Dish. Dish Network’s chairman Charlie Ergen has made it known on numerous occasions that Dish’s priorities rest in the wireless business and the company is willing to walk away from networks if the licensing prices are too high. For Dish customers, this has resulted in numerous showdowns and blackouts over the last several years. But this time it stung more than usual.

Regardless of whether the dispute was warranted, the timing couldn’t have been worse for Dish Network and Sling TV. Delivery of ESPN is a primary value proposition for both, and suddenly 10 million U.S. households didn’t have access to college football. Worse, the following day was NFL Sunday, and the day after that a hotly anticipated Monday Night Football game. Football fans on Dish and Sling were suddenly blacked out of three consecutive days of football—a grim fate for customers paying rising monthly rates for a shrinking number of networks. But rather than sit down and take it, football fans took matters into their own hands.

There are few people as dedicated as sports fans, and it didn’t take long for word to spread—you could sign up for YouTube TV to watch the games. Despite costing $30 more a month, YouTube TV subscriptions shot up—and so did Dish Network and Sling TV cancellations. In the second quarter alone, both Dish Network and Sling TV lost a combined 252,000 subscribers without any major programming disruptions. While there are no numbers to show how many of those moved over to YouTube TV, Twitter was abuzz with disgruntled football fans making the switch—and swearing this was the last time they’d subject themselves to a licensing showdown that found fans paying the price.

Disputes like this one come at a time when media companies are prioritizing their own direct-to-consumer streaming services over traditional pay TV channels. This prioritization has accelerated cord-cutting as viewers look to get the easiest and best access to their favorite programming like sports. One analysis shows that the number of pay TV subscribers fell 6.1% in the second quarter of 2022, and just recently CTV outperformed linear TV in viewership for the first time. This week’s showdown will surely drive those numbers higher.

The idea that CTV is getting a bigger lead over linear TV isn’t exactly shocking. Recently, Reed Hastings, co-CEO of Netflix, publicly predicted that “it’s definitely the end of linear TV over the next five, ten years.” And with research showing that linear TV subscribers are expected to decline by 27 million by 2024, Hastings’ comment doesn’t feel particularly controversial. However, TV network executives beg to differ—and recently made their case to Adweek ahead of their new fall lineups.

For these executives from ABC, CBS, NBC, and the CW, the rebuttal mostly centered around longevity and value. “Linear TV has survived everything technology has thrown at it for a long, long time,” said Kelly Kahl, CBS Entertainment’s president. “It’s survived cable. It’s survived DVRs and VCRs. Just about anything.” Kahl also pointed to local broadcast stations being free and offering benefits not available on streaming, like local stations covering severe weather. Other executives that Adweek talked to argued that linear TV still edges out Connected TV when it comes to live events—though as this week’s Disney/Dish scuffle demonstrated, there are limits to linear TV’s strengths in this category.

While a handshake deal was made between Disney and Dish on Sunday night, an entire weekend of games had been blacked out for football fans. The ESPN blackout isn’t the first of its kind on broadcast television—and it won’t be the last. Meanwhile, linear TV evangelists, including the network executives that Adweek spoke to, raise good points about the platform’s strengths. But it’s a sign that TV has changed when the leaders of the biggest networks in the world are on the defensive, making arguments for relevancy. Traditional TV providers, once used to holding all of the cards, have lost negotiation leverage now that there are easier alternatives for both consumers and publishers in CTV.

And as these networks continue to pivot to streaming, like NBC with their Peacock service, and media conglomerates gobble up market share, the landscape is bound to shift further downfield. For streaming services, there may come a time when there’s little to no economic incentive to keep making linear contract negotiations—but there will be value in building up the streaming services instead. And that may be the winning play for sports fans.