We’re Bringing Real-World Measurement to Real-Time Reporting — Introducing Offline Attribution

by Melissa Yap

3 Min Read

CES 2024: Stagwell (STGW) and MNTN Announce Partnership in Unified Performance SolutionsLearn More

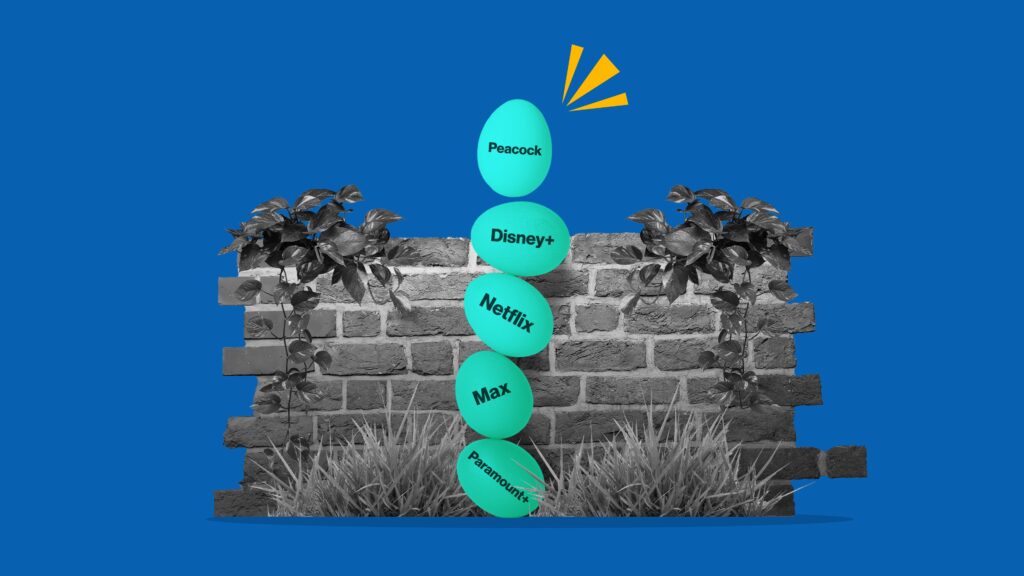

Streaming Services, Tear Down This Wall

4 Min Read

The streaming industry has had a tumultuous few weeks. While streaming services continue to grow as linear TV drops to 1980s levels, the industry remains at the focal point of two historic Hollywood strikes over fair compensation. Now new arguments have been made that services are purposefully hiding viewership data to cover up bombs while Netflix and Microsoft are at odds over slow ad growth on the legacy service.

Sound like a bunch of bad news for advertisers? In fact, the opposite may be true. But it’s going to require a little bit of savviness and technology solutions to pave over the pitfalls.

The dual writers’ and actors’ strikes in Hollywood continue to drag on, and it’s shining a light on how streaming services report success metrics. One of the key sticking points of the strikes revolves around how writers and actors are compensated for their work in streaming — but streaming companies continue to be secretive about their viewership data. A recent Bloomberg piece has now taken the argument one step further — arguing that streamers aren’t hiding their hits, but rather covering up bombs in an effort to look more competitive in a cutthroat landscape.

Unlike linear TV, where a show’s success was calculated based on viewership (thus helping networks profit by selling ads), the success equation is much more complicated today. This includes streaming services luring subscribers in with intriguing content and keeping them engaged to extend the user’s stay. Producer Jason Blum argues that the lack of transparency around these metrics distorts the market — convincing viewers that some shows are more popular than they really are.

This lack of transparency isn’t just impacting actors and writers; advertisers are feeling the pinch and starting to push for more data. While CTV’s targeting capabilities mean that brands aren’t buying certain time blocks for the viewership, advertisers still need to know what services have the must-see content — especially if they’re buying ad content directly from the service.

One of the services that has traditionally been a little cagey about viewership metrics is Netflix.

Last year the service found itself losing hundreds of thousands of subscribers amid its multiple price hikes — prompting it to backtrack on its long-held anti-ad stance for a more affordable, ad-supported model. After an intense courting period with multiple tech companies, Netflix announced Microsoft as its advertising partner, finally launching its ad-supported subscription tier in November 2022.

Within weeks, news broke that Netflix was unable to follow through on its promises to advertisers. Now the service has announced during a Q2 earnings call that its advertising is not producing “material” revenue, and is reportedly focusing on attracting more advertisers. To that end, they’re restructuring their exclusive ad agreement with Microsoft. To help seal the business deal last year, Microsoft initially offered Netflix a revenue guarantee. But after mounting frustrations with the service’s lower-than-expected ad sales growth, Microsoft has agreed to let Netflix include other ad partners for a reduced guarantee.

This could be great news for advertisers. If Netflix drops the exclusivity deal, brands might see reduced buying obstacles, greater ease of audience scaling, and significantly more advertising opportunities. Further, by not having to buy directly from Microsoft, advertisers could now bypass a lot of extra work not required with other programmatic streaming services.

Bloomberg’s report, the ongoing strikes, and Netflix’s ad restructuring all point to a common theme: there needs to be more clarity around ad-supported content and viewership. As the market continues to fragment and expand, we’ll see more services experimenting with advertising options — and more content competing for eyeballs.

This will lead to a higher increase in “churn-and-burn” viewers, the audiences that subscribe to a service for a month to binge exclusive content, then unsubscribe and wait for another content drop. Not only will staying inside walled gardens lead to missed opportunities to target these audiences, but it forces advertisers to rely on the accuracy of streaming services’ viewership data—data that is not always readily transparent. CTV advertising platforms that offer cross-service tracking and ad serving like MNTN Performance TV can help remediate this problem. While the issue of transparency may continue into tomorrow, advertisers can use the technology of today to help navigate these murky waters.

Other CTV News You Need to Know: